how much is vehicle tax in kentucky

If you are unsure call any local car dealership and ask for the tax rate. Search tax data by vehicle identification number for the year 2020.

Kentucky House Votes To Give Relief On Vehicle Tax Bills News Wpsd Local 6

The Center Square Kentucky lawmakers are working on an immediate fix to the states motor vehicle property tax which is expected to rise substantially this year.

. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. A 200 fee per vehicle will be added to cover mailing costs. Vehicle Tax paid in.

Kentucky Revised Statute Section 64012 as amended by House Bill 537 mandates the following fee changes. Vehicle Tax Costs. This means that depending on your location within Kentucky the total tax you pay can be significantly higher than the 6 state sales tax.

The rise is not due to an increase in the rate. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Due to supply chain hiccups caused by the coronavirus pandemic.

Payment methods include VISA MasterCard Discover or American Express. 22 Permanent Disabled Placard. Thats a 46 percent increase in taxes.

In 2022 the owner of the same car will pay 29548 based on a trade in value of 24200. Retail Tax could be 6 of the current average retail listed in the NADA Used Car Guide 6 of the sale price or 90 of the MSRP Manufacturers Suggested Retail Price for new vehicles. The state in which you live.

Varies by Weight Motor Vehicle Transfer. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. Vehicle Tax paid in 2020.

Usage Tax-A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Its fairly simple to calculate provided you know your regions sales tax. 6 Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

The type of license plates requested. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

Vehicle tax or sales tax is based on the vehicles net purchase price. Key Takeaway No matter where you shop for a car in Kentucky your sales tax rate will be 6 of your total purchase price. 21 Motor Vehicle Renewal of 10000 lb Plates or Greater.

17 Motor Vehicle Title Application. Car loans in Kentucky 2022. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Of course you can also use this handy sales tax calculator to confirm your calculations. Dealership employees are more in tune to tax rates than most government officials. Whether or not you have a trade-in.

Hmm I think. On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. Vehicle tax bills to see big jump is 2022.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Every year Kentucky taxpayers pay the price for driving a car in Kentucky. Payment methods include American Express Discover MasterCard or VISA.

On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public. The tax is collected by the county clerk or other officer with whom the vehicle is.

9 Title Lien Statement. A portion of the fees collected in this transaction includes funds to develop maintain and enhance the states official web portal Kentuckygov. Depending on where you live you pay a percentage of the cars assessed value a price set by the state.

Once you have the tax rate multiply it with the vehicles. You can find these fees further down on the page. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually.

The county the vehicle is registered in. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. How much will my car taxes be in KY.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. 0 Temporary Disabled Placard.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. 246 cents per gallon of regular gasoline 216 cents per gallon of diesel.

Sticker shock in 2022 isnt just in store for those shopping for new vehicles or are finding that used vehicles arent as. 083 average effective rate. A 200 fee per vehicle will be added to cover mailing costs.

The taxable value of cars leapt by about 40 between 2021 and 2022 because Kentucky uses national car value estimates to decide how much people will be taxed and used car prices skyrocketed during. Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top of the state tax. It is levied at six percent and shall be paid on every motor vehicle used in.

New car sales tax OR used car sales tax. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

Car Tax By State Usa Manual Car Sales Tax Calculator

In State Transfers Daviess County Kentucky

Ford Kentucky Truck Plant Factory Tour Trucks Diesel Trucks Big Trucks

Sales Tax On Cars And Vehicles In Kentucky

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Party Invite Template Christmas Party Invitation Template

Motor Vehicle Taxes Department Of Revenue

Things That You Must Know About Irp Cab Card Correction Registration Paying Taxes Tracking Expenses

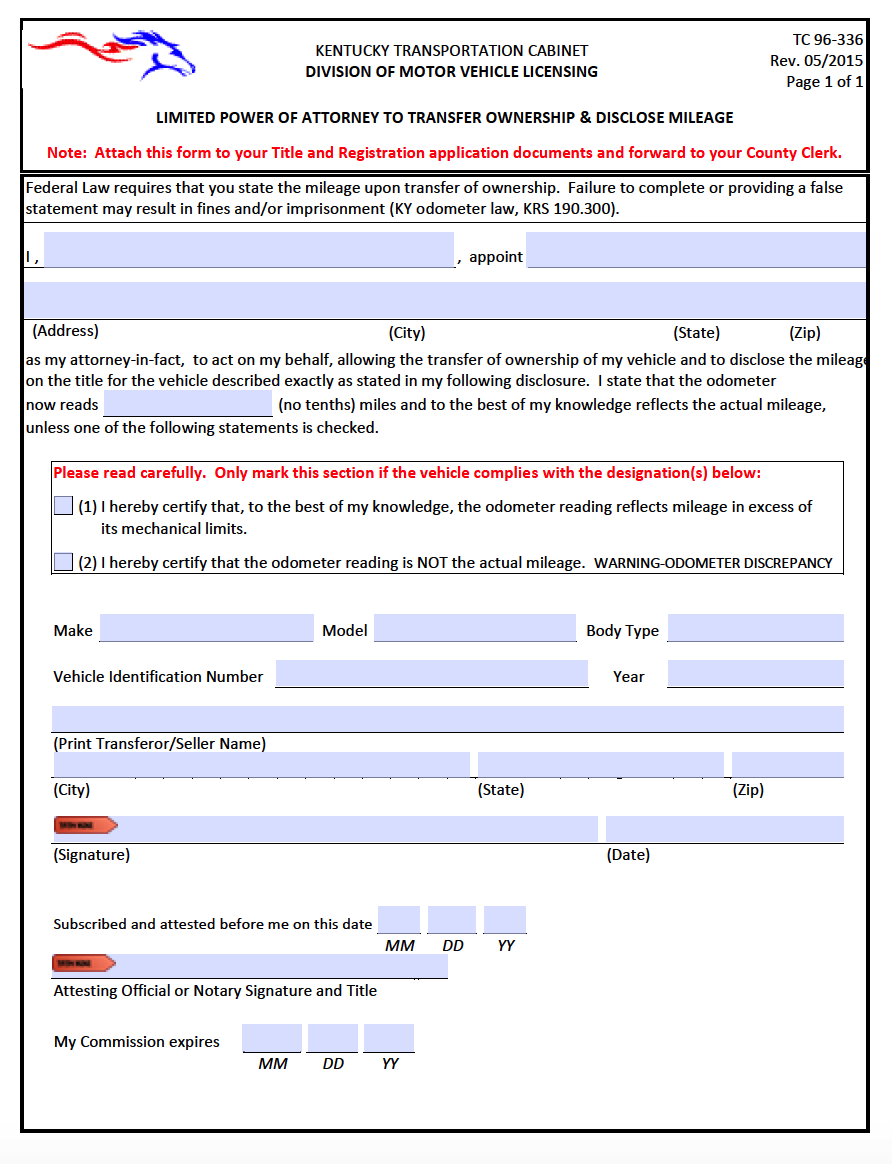

Free Motor Vehicle Power Of Attorney Kentucky Form Tc 96 336

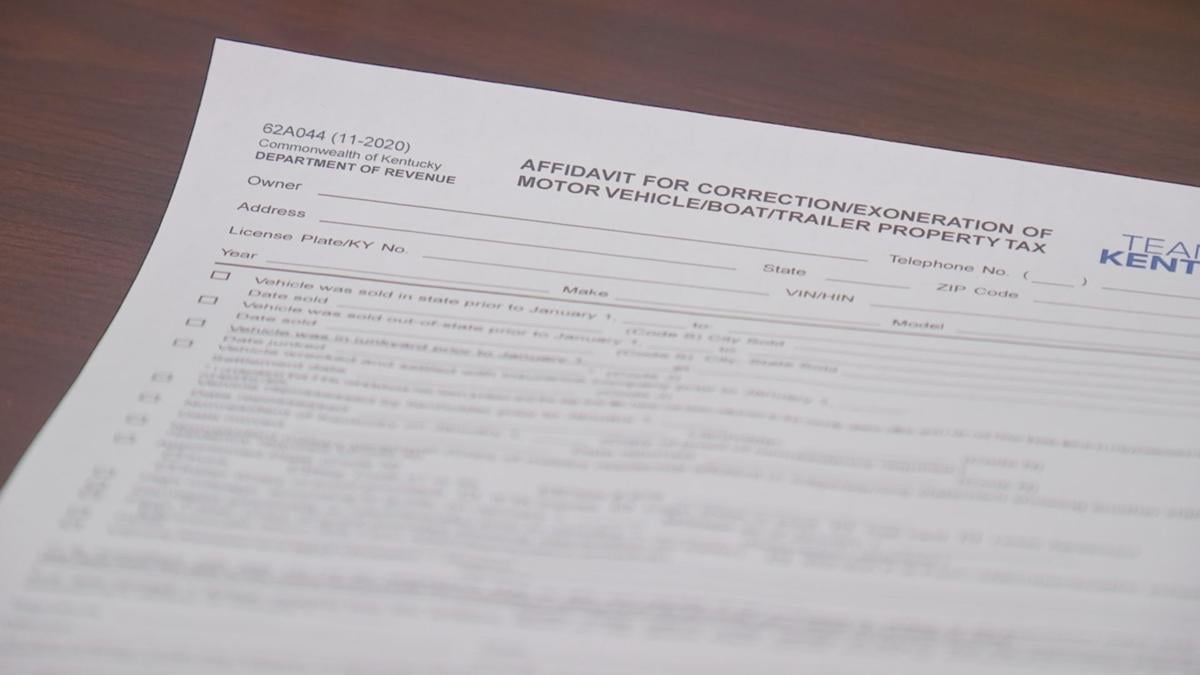

Wkyt Investigates Rising Car Taxes

Title Transfer Or Title Registration Global Multi Services Truck Stamps Trucking Companies Commercial Vehicle

Eform2290 File Irs Form 2290 Online E File 2290 For 2021 Irs Forms Irs

Global Multi Services For Irp New Carrier Renew Tracking Expenses Service

Kentucky Vehicle Inspection Form 15 Things To Avoid In Kentucky Vehicle Inspection Form Vehicle Inspection Vehicle Maintenance Log Inspection Checklist

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year News Wpsd Local 6

Global Multiservices Contact Us Today To Discuss Your Ifta Filing Assistance Options Tax Return Truck Stamps Global

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year News Wpsd Local 6

Cash For Your Car In Kentucky Free Same Day Pickup Car Title Kentucky Id Card Template